Page 37 - STATE v ARIF & ORS. SC-NO-540-2022 PART 1

P. 37

. '}'I'

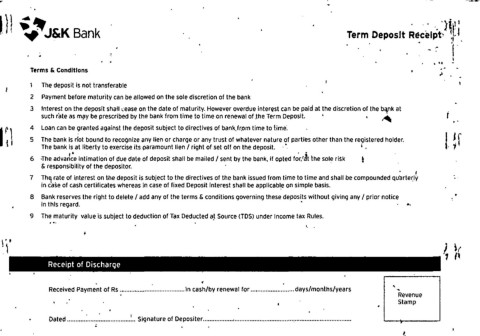

l) l ... ,.J&K Bank Term Deposit Receipt· J.l

'!

' " '

Terms & Conditions

The deposit is not transferable

2 Payment before maturity can be allowed on the sole discretion of the bank

3 Interest on the deposit shatl .:ease on the date of maturity. However overdue interest can be paid at the discretion of the b'Vlk at

such rate as mf!y be prescribed by the bank from time to time on renewal of ~he Term Deposit. • , "" ..

4 Loan can be granted against the deposit subject to directives of bank.fr.om time to time~

5 The bank is n'ot bound to recognize any lien or charge or any trust of whatever nature of parties other than the registered holder.

The bank is at liberty to exercise its paramount lien I right of set off on the deposit. • 1

6 ·The advaJ:e intimation of due date of deposit shall be mailed I sent by the bank, if opted f~r.rcft the sole riSk

& responsibility of the depositor.

'

7 Th~ rate of interest on the deposit is subject to the directives of the bank issued from time to time and shall be compouAded qu"arte~IY

in caSe of cash certificates whereas in case of fixed Deposit interest shall be applicabl_e on simple basis.

8 Bank reserves the right to delete I add any of the terms & conditions governing these deposits without giving any I prior notice •

in this regard. • ...

9 The maturity value is subject to deduction of Tax Deducted a~ Source <TDS) under Income tax Rules.

r·

' Receipt of Discharge

Received Payme~t of Rs .•................. : ................... in cash/by renewal for ................... : ...... days/months/years

Revenue

Stamp

Dated ........... : ....... : .................. ~ .. Signature of Depositer ........................................................................................ .